Kochi: Retail focused and technology driven Housing Finance player, IIFL Home Finance Ltd. (“IIFL HFL”/ “Company”) has announced the opening of its public issue of Secured Redeemable Non-Convertible Debentures (“Secured NCDs”) of the face value of ₹ 1,000 each.

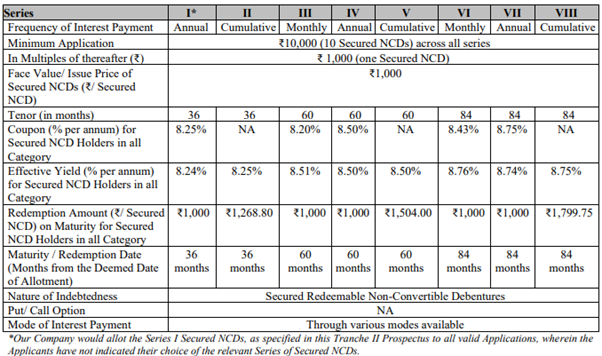

The Tranche II Issue includes a Base Issue Size for an amount of ₹ 100 crores (“Base Issue Size”) with an option to retain oversubscription up to ₹ 900 crore aggregating up to ₹ 1,000 crores (“Tranche II Issue”). The Secured NCD issue offers various options for subscription with coupon rates ranging from 8.20% to 8.75% per annum. The Tranche II Issue opens on December 08, 2021 and closes on December 28, 2021, with an option of early closure or extension.

The Secured NCDs bear a fixed rate of interest under eight different series and have been rated “CRISIL AA/Stable” and “BWR AA+/ Negative (Assigned)” indicates that instruments with this rating are considered to have high degree of safety regarding timely servicing of financial obligations and carry very low credit risk.

Net proceeds of the Issue will be utilized for the purpose of onward lending, financing, and for repayment/prepayment of principal and interest of existing borrowings of the Company (at least 75%) - and the rest (maximum up to 25%) for general corporate purposes.

As on September 31, 2021 its CRAR, in accordance with the Reformatted Financial Statements this was at 30.75%.

The company’s main focus on providing loans to first time home buyers in the Economically Weak Society and Lower Income Group segment in the suburbs of Tier 1 cities, Tier 2 cities and Tier 3 cities in India where the collateral is a proposed self-occupied residential property. As on September 30, 2021 it has served over 157,000 customers, of which 52.77% were self-employed and 47.23% were from the salaried class.

Its Asset Under Management saw a CAGR growth of 7%, where it grew from ₹18157.83 crores as of March 31, 2019 to ₹ 21474.26 crores as of September 30, 2021.

The Lead Managers to the issue are Edelweiss Financial Services Limited, IIFL Securities Limited*, ICICI Securities Limited, Equirus Capital Private Limited and Trust Investment Advisors Private Limited.

Gurugram, India – October 11, 2023: Samsung announced exciting offers

Bangalore, 10th October 2023: The Nokia G42 5G (16GB+256G

Bengaluru, October 10, 2023 IN-SPACe (Indian National Space Promotion and

New Delhi, October 3, India- Philips India announces an exciting co

Through this exciting initiative, the brand aims to emerge as the go-to purveyor of authentic Chinese in India

New D

Jaipur, 18 April: Students of Jaipur have recently shown their remarkable achievement in the UPSC Civil Services Examination-

· Technopark-based Lifology holds conversation on IER 2024

Thiru